Are you a small business owner looking to streamline your invoicing process while staying compliant with tax regulations? Look no further than ClickUp's Tax Invoice Template for Microsoft Word and more! This template allows you to easily customize and generate professional tax invoices, ensuring accurate tracking of sales transactions and providing vital information for your financial records. With ClickUp's user-friendly template, you can save time and effort while maintaining the professionalism and accuracy of your invoicing process.

Ready to level up your invoicing game? Try ClickUp's Tax Invoice Template now!

Creating professional and accurate tax invoices is crucial for small business owners to stay organized and compliant. The Tax Invoice Template for Microsoft Word, ClickUp, & More offers a seamless solution by:

To help small business owners stay organized with tax invoices, ClickUp’s Tax Invoice Template for Microsoft Word, ClickUp, & More includes:

Creating a tax invoice can be a breeze with the Tax Invoice Template in ClickUp. Follow these steps to streamline your invoicing process and ensure accuracy:

Start by entering your business name, logo, address, contact information, and tax identification number. Including these details ensures that your invoice looks professional and meets legal requirements.

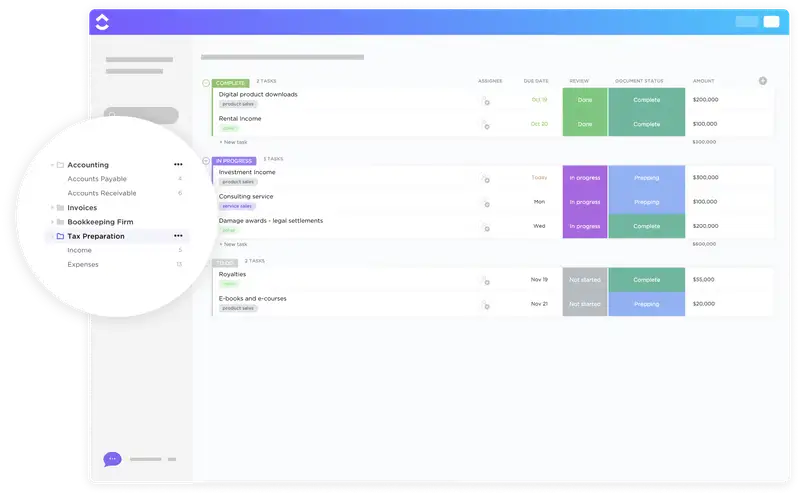

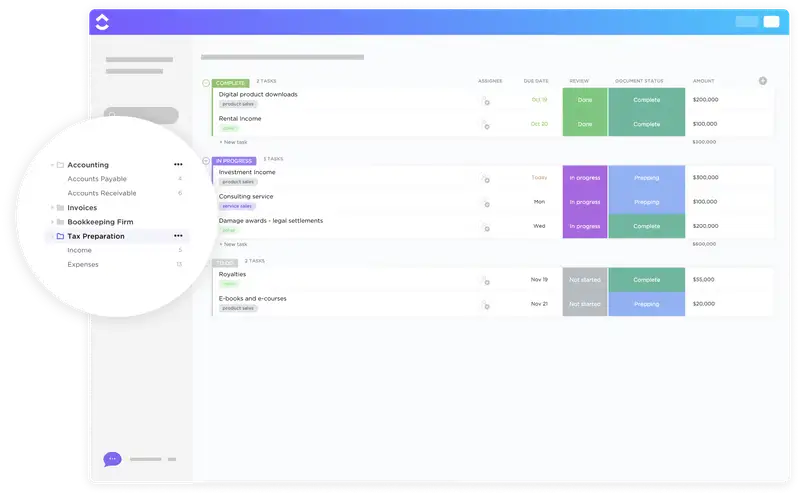

Use the Table view in ClickUp to neatly organize and input your business details.

Next, include the customer's name, address, and contact information. If you have specific customer identification numbers or references, make sure to include those as well for easy reference and tracking.

Use custom fields in ClickUp to input and manage customer information efficiently.

List all the products or services provided to the customer along with their descriptions, quantities, rates, and total amounts. Clearly itemizing each line helps both you and your customer understand the breakdown of charges.

Create tasks in ClickUp to itemize and categorize each product or service for accurate invoicing.

Calculate the total amount due, including any applicable taxes or discounts. Clearly state the payment terms, due date, and accepted payment methods to ensure timely payments and avoid any misunderstandings.

Utilize Automations in ClickUp to set reminders for payment due dates and streamline the invoicing process.

By following these steps and using ClickUp's Tax Invoice Template, you can create professional, accurate invoices efficiently and keep your finances organized.

This template is originally designed for use in the ClickUp platform, but you can easily export this doc for use in Microsoft Word, or even just copy-paste the contents into your platform of choice.

Small business owners can streamline their tax invoicing process with the ClickUp Tax Invoice Template for Microsoft Word, ClickUp, & More.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Ensure you specify the Space or location in your Workspace for this template.

Next, invite relevant team members or guests to your Workspace to start collaborating.

Now, leverage the template's features to create accurate tax invoices: